#Lucid stock symbol update

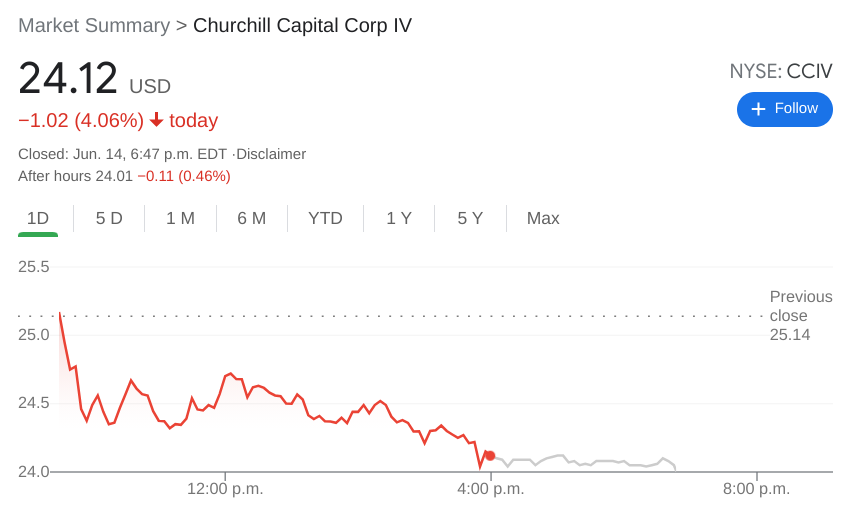

Update March 24: Churchill Capital Corp IV (NYSE: CCIV) has kicked off Wednesday's trading session with a bounce above the $24 level and paring a small part of its losses recorded on Tuesday. Both were levels where Lucid's stock (still represented by the CCIV ticker) found its feet in recent weeks. Looking down, some support awaits at $26.77, followed by $24.40. Investors are eyeing the psychological barrier of $30 and it is followed by last week's closing high of $31.10 as the next upside target. The recent news is set to boost shares early on Monday, with pre-market trading data pointing to an increase of over 2% to $27.60. Traders that have bought equity at the lofty highs above $60 are still licking their wounds, while bargain-seekers that scooped up shares at the March trough of $22.09 are happy to see prices stabilize above $26. After soaring, shares suffered a "buy the rumor, sell the fact" episode, and the dust has yet to fully settle. This growth story described above should allow publically listed Churchill Capital Corp IV (NYSE: CCIV) to rise after several turbulent weeks following the SPAC merger. Manufacturing additional vehicle types would allow Lucid Motors to increase its cash flow, especially as its current order book is "filling up." The current offering of Lucid Air cars is set to show up on the streets in the second half of 2021. Nevertheless, seeing a picture of a future car provides investors with hope about additional products in Lucid's pipeline. Images leaked show its future Gravity SUV, which will is set to roll out only in 2023. The Arizona-based electric vehicle company is looking to sell cars in Europe and filed papers in the EU's Intellectual Property Office in Brussels. The last piece of news comes from the other side of the world. It also remains unclear if the energy would be used for commercial or residential clients, but the expansion story is promising. At this point, the plans are preliminary and for an initial experiment. The company is set to enter the energy storage market with its batteries. When Peter Rawlinson, Lucid's CEO, spoke with CNBC's Jim Cramer, the headline was " bring on the competition." The former Tesla engineer referred to the rumored Apple Car rather than products from his former employer, but he may be on the cusp of competing with Elon Musk in another field – batteries. Shares of the blank-check company that recently announced a SPAC merger with Lucid Motors has reasons to spring higher. The sun is shining and birds are chirping – spring has officially begun and it may see Churchill Capital Corp IV (NYSE: CCIV) blossoming. The SEC is looking closely at the SPAC sector.

Gamestop and AMC are up 20 and 40% respectively! CCIV shares are currently $22.20 on Thursday, down 1.7%. Surprising, given the huge rallies seen in other meme stocks. Update March 25: Shares in CCIV/Lucid Motors continue to struggle on Thursday. Churchill/Lucid shares are trading at $23.53 on Friday, down 2%. The SEC announcing it is to look into SPAC deals is also weighing on CCIV. NIO suspending production for five days is likely not helping. Update March 26: CCIV shares are suffering on Friday, dropping 2% in early trade. Churchill Capital and Lucid deal one of biggest SPAC deals recently.NIO suspends production for 5 days due to chip shortage.NYSE: CCIV down again on Friday as SEC looks into SPAC deals.

0 kommentar(er)

0 kommentar(er)